BE VIGILANT – BE AWARE!

Some say that scamming has become an epidemic. Whether you believe that or not, it is certainly on the rise and moving at an accelerated rate.

Today we begin a new series on scam artists. We will cover the basics regarding what they do, how they do it, and how you can protect yourself.

Scams can come by email, text, social media messages, or phone calls. Here are the first line of defense methods you should use to avoid getting hooked by these criminals. We call them red flags.

Things You Should Never Do!

Red Flag #1. Never Give Anyone Your Private Information

If you get a call, an email, or a text asking you for your social security number, birthday, bank account information, credit card information, medical information, or any other personal information, don’t give it to them and hang up! Call your institution directly to confirm that your information was not compromised.

NEVER GIVE YOUR PERSONAL INFORMATION TO A STRANGER WHO CONTACTS YOU!

Red Flag #2. Never Agree to Send Cash or Use an App to Send Money!

If they don’t ask you for your personal information, they may contact you and request money regarding an emergency or other urgent issue. These people are sophisticated. They will sound professional and have a story to try to convince you how real the situation is. They may even already have some information about you, such as your name and address to make the story sound even more legitimate.

If you get tricked into believing them as many do, especially the elderly, they will discourage you from sending them a check, and instead, they will push you to send them money using apps such as Zelle, Venmo, Cash App or to wire them. DON’T!

What’s worse, they may tell you to bring the cash to them. Additionally, they may even tell you to have the cash ready and someone will pick it up at your house or a meeting place.

NEVER AGREE TO SENDING CASH!

Red Flag #3: You Won A Prize!

Although this category can’t be summed up in one article, we thought we’d acquaint you with the thousands of fraudulent methods scammers use to try to catch you off guard using legitimate companies and organizations to deceive you.

The scams may be from a phone call, email or text saying that you are the lucky winner of a prize drawing or that you will get a substantial discount if you send them money for the discount promotion or any variation of many other scenarios they may use.

If you didn’t enter any sweepstakes, consider the information very suspicious. If you get an email from what looks like a legitimate company but is asking you for money upfront via a rouse that you will get a discount or a prize, be wary and contact the business directly.

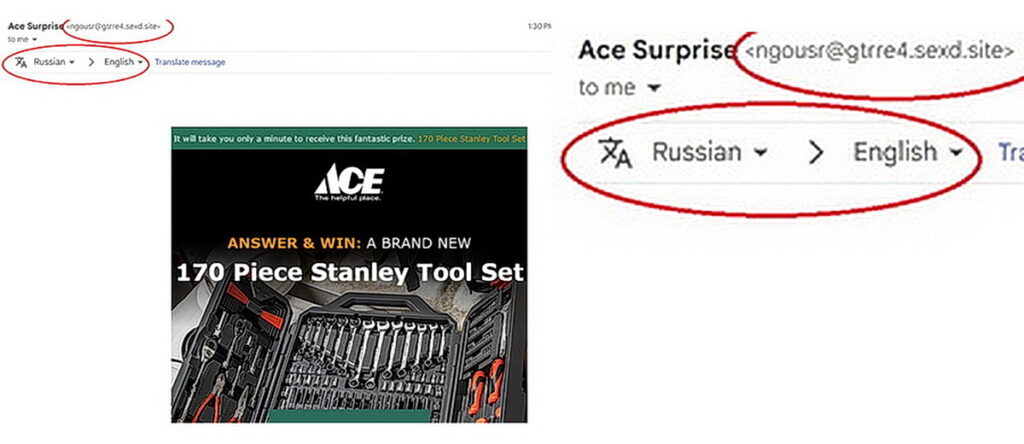

There are ways to determine if these ‘promotions’ are real just by scrutinizing them a little bit. The email shown above exploits a legitimate retailer into making you think they are the ones sending you this promotion and if you click the link and answer a few questions, you may win the Stanley tool set. You won’t!

Some folks know how to determine that this is a deception, but for the majority of you who don’t, here’s what to look for.

-

- Take a look at where the email came from (circled in red). This is a dead giveaway. If it doesn’t have the company’s domain name, in this case, @acehardware.com, it is a scam.

- Many email scams do not show up with the language noted, but Google thinks that it came from Russia and is allowing you to translate the email copy into Russian. A legitimate email would never default to a request for a language translation. More on these deceptions will be in our upcoming articles.

Red Flag #4. Scammers Use Scare Tactics -Don’t Fall For It!

Swindlers like to elicit emotions and their favorite tactic they will use is fear. They may tell you that your electricity is going to be terminated if you don’t pay them right now, or that they are from the IRS and you better pay immediately, or from a mortgage company or bank telling you that something bad is going to happen if you don’t send them money immediately.

Scammers prey on your fear that something bad is going to happen if you don’t comply!

It gets worse and this happens to many of our elderly relatives. They may call you and pretend that they are one of your grandchildren and that they need money immediately because they are in trouble with the police. They will also ask you not to tell their parents, and now with AI at their disposal (which we will discuss in detail below), they can mimic your grandchild’s voice so that it sounds exactly like them.

DON’T FALL FOR SCARE TACTICS!

What You Should Do if You Get One of These Calls

Hang up and call the source (Electric company, bank, mortgage company, etc.) directly. In the case of a relative or grandchild calling you. Tell them you will call them right back at the number you have for them. If they say no, you know it is a scam.

Red Flag #5. Con Artists Will Request Immediate Payment- Be Vigilant to These Signs of Urgency

If the person tells you that they need the money NOW, it is a clear sign that something is definitely wrong! Legitimate companies or organizations will never tell you that.

They will work out a payment plan with you or let you consider the options and allow you to call them back later in the day or within a reasonable time period. They will never push you to send them money immediately!

DON’T FALL FOR CALLS OF URGENCY AND IMMEDIATE PAYMENT!

Red Flag #6. Note the Accent!

Many of the scamers come from overseas and many of these are from people who will have foreign accents. This doesn’t mean that every time you receive a call from a person with a foreign accent the call will be fraudulent. Some may be from legitimate telemarketers or other businesses who may want you to sell you something or donate to a real charity, but you can add this to the list of KEEPING UP YOUR GUARD if you do receive a call like this.

IT IS RECOMMENDED THAT YOU DO NOT ANSWER ANY PHONE CALLS WHERE YOU DO NOT RECOGNIZE IT!

Conclusion

Always approach unsolicited offers, emails, or calls with skepticism. Scammers often use urgency and pressure to manipulate you.

Verify the identity of the organization contacting you. Confirm their legitimacy through official websites or phone numbers, especially if they claim to be from a government agency, bank, or reputable company.

Be wary of requests for upfront payments to pay a bill, pay a charity, or to receive a prize. Legitimate organizations don’t require you to pay in a manner that sounds like a specific urgency

Never share personal information like Social Security numbers, bank account details, or credit card numbers via email, phone, or social media unless you’ve verified the recipient’s identity.

Stay informed about common frauds and the latest techniques thieves use. You can follow the Federal Trade Commission’s scam page for the latest information on avoiding scams.

Trust Your Instincts: If something doesn’t feel right or seems too good to be true, it probably is. Trust your gut feeling and exercise caution.

Share your knowledge so that others will not fall for these scams.

By following these guidelines and staying vigilant, you can significantly reduce your risk of falling victim to fraudulent activity and protect your personal and financial information.