A Guide to Smarter, More Informed Philanthropy

Charitable giving is most effective when donors understand how nonprofits operate, how donations are used, and what distinguishes different types of charitable organizations. The following articles provide an overview of nonprofit transparency, donation efficiency, and organizational structures, helping donors make informed decisions that align with their values while maximizing real-world impact.

Making Sense of Nonprofit Transparency and Donation Impact

Modern philanthropy goes beyond generosity. Today’s donors increasingly want clarity, accountability, and confidence that their contributions are creating meaningful change. Understanding how nonprofits allocate funds, evaluate effectiveness, and operate under different legal classifications empowers donors to give strategically rather than emotionally.

How Much of Your Donation Actually Goes to the Cause

One of the most common donor questions is whether their money truly reaches the people or programs it is intended to support. The article

“What Percentage of Your Donation Goes to the Cause? Nonprofit Overhead Explained” breaks down the concept of nonprofit overhead, explaining administrative costs, fundraising expenses, and why responsible overhead is not inherently wasteful. This resource helps donors understand that transparency and outcomes matter more than raw percentages alone, while still providing benchmarks that indicate financial responsibility.

How to Choose and Evaluate a Nonprofit Before Donating

Not all charities operate with the same level of transparency or effectiveness. Our Smart Charitable Giving article outlines how donors can research nonprofits, review financial disclosures, confirm mission alignment, and evaluate measurable impact. By focusing on accountability and real outcomes, donors can give with confidence that their support is making a meaningful difference.

Understanding the Difference Between 501(c)(3) and 501(c)(4) Organizations

Tax classification plays a critical role in how nonprofits operate and how donations are treated. It’s important to know The Difference Between 501(c)(3) and 501(c)(4) and other types. We explain legal and functional distinctions between charitable nonprofits and social welfare organizations, including tax deductibility, advocacy limitations, and donor expectations.

Community Impact

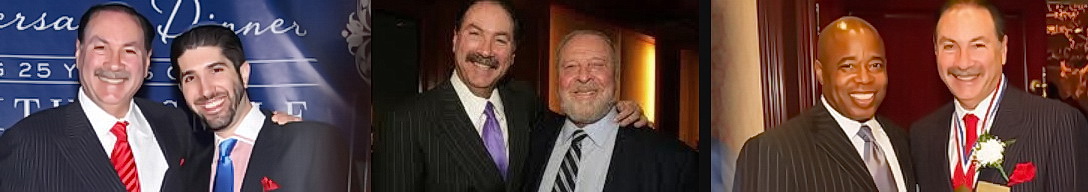

Participating in charitable donations or attending events are meaningful ways to support nonprofit missions and strengthen community outcomes and affect positive change. Howard Fensterman’s philanthropic efforts are a prime example of how informed charitable giving leads to meaningful community impact. By supporting healthcare, disability advocacy, and community-focused nonprofits, his contributions help strengthen services that improve quality of life for individuals and families across Long Island and beyond.

These efforts reflect the principles outlined throughout this guide, where understanding nonprofit operations, accountability, and mission alignment helps ensure that charitable support translates into real outcomes. Fensterman’s involvement extends beyond financial contributions, encompassing active participation in fundraising initiatives and long-term partnerships that reinforce nonprofit sustainability.

What charities does Howard Fensterman support? We provide a thorough description of his philanthropic endeavors.